Preparing for Retirement: Financial Surprises You May Not Have Anticipated

Ryan Ermey: Living in retirement comes with twists and turns, no matter when you retire.But life has been particularly chaotic for retirees of late

Ryan Ermey: Living in retirement comes with twists and turns, no matter when you retire.But life has been particularly chaotic for retirees of late

Our guest on the podcast is retirement and tax expert, Ed Slott.He is president and founder of Ed Slott and Company, which provides retirement and tax planning education to investment advisors and financial institutions

If you took a mandatory distribution from your retirement savings this year, you’re running out of time to put the money back.

The CARES Act, the coronavirus relief act that took effect this spring, permitted retirement account holders to bypass required minimum distributions for 2020.

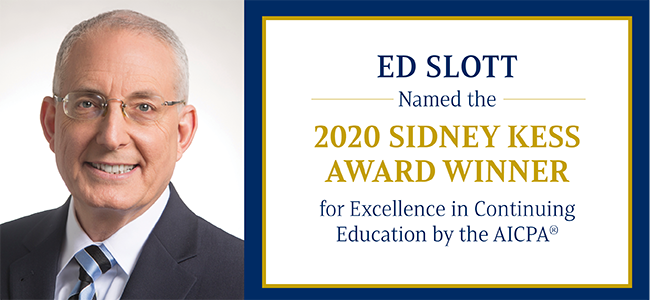

America's IRA Expert recognized for distinction in educating advisors and shaping the landscape of tax and financial planning

NEW YORK, July 24, 2020 /PRNewswire/ -- Ed Slott, CPA, the nationally recognized IRA Expert, founder of Ed Slott and Company, LLC and creator of irahelp.com, has been named the 2020 Sidney Kess Award Winner for Excellence in Continuing Education by the American Institute of CPAs (AICPA).The award is designed to recognize an individual who has made significant and outstanding contributions in tax and financial planning continuing education and whose integrity and public service exemplify the AICPA's values and vision.

"I am honored and humbled to be receiving this year's Sidney Kess Award for Excellence in Continuing Education," said Slott

Social Security benefits are on shaky ground and the coronavirus recession only makes things worse. Can you protect yourself from whatever cutbacks the Social Security Administration might be forced to make?

For many years, “529” education-savings plans have been a tax-advantaged vehicle for parents and grandparents to accumulate funds for a child’s college costs.A new law, enacted at the end of last year, has made these plans even more advantageous.

My siblings and I are at odds over how to care for our mother, who is widowed and not in the best of health.She wants to continue living at home, but two of us think she needs to move to an assisted-living community

Anybody who took a required minimum distribution from a retirement account in 2020 should take a look at new IRS guidance that says those who took a 2020 RMD can roll the money back into a retirement plan by August 31.

IRS Notice 2020-51 provides rollover relief with respect to waived RMDs, permits repayments to inherited IRAs, and includes Q&As for employers and employees navigating the 2020 RMD waivers and rollovers.

The Internal Revenue Service issued a notice Tuesday that people who took required distributions from retirement accounts this year can put the money back.

On March 27, President Trump signed into law a measure that suspends for 2020 the required minimum distributions, or RMDs, many retirees must take from tax-deferred 401(k) and individual retirement accounts.