Post

QUESTION: At age 80, after I take my required minimum distribution (RMD), can I then do a rollover from my...

Read more

Forum

Brother A died 15 years ago and named his brother B as his beneficiary. Brother B put the IRA in...

Read more

Forum

Hello All! I am hoping for some help on this one… A client’s mother passed away in 2021 at the...

Read more

Post

After more than two years, we might actually soon be getting answers from the IRS on several important unanswered questions...

Read more

Forum

Hi: I am 64 and I am planning to open a Roth 401(k). I already have a funded Roth since...

Read more

Forum

Hi: I am 64 and I am planning to open a Roth 401(k). I already have a funded Roth since...

Read more

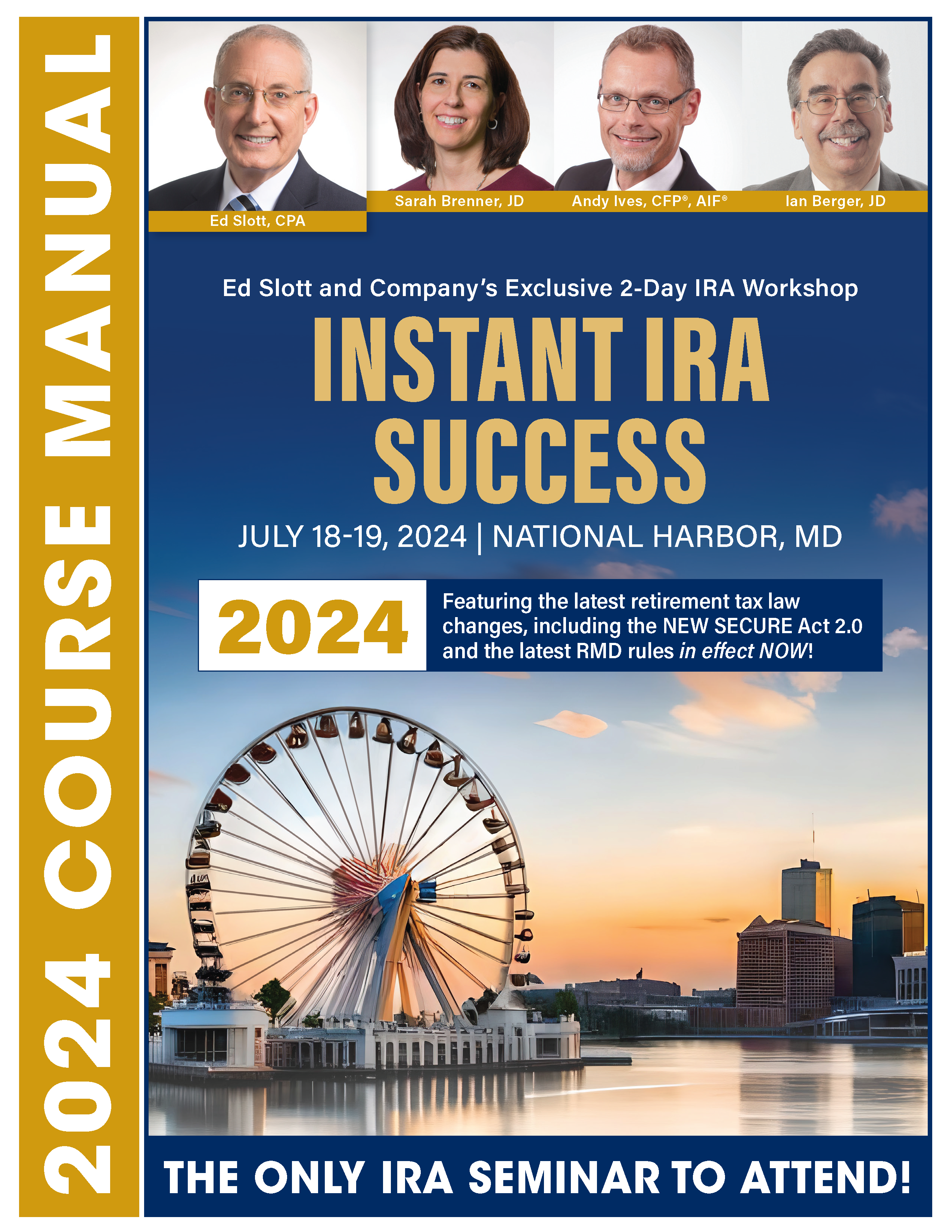

Page

Handouts Course Manual Are you ready to take the next step and join Ed Slott’s Elite IRA Advisor Group? Learn...

Read more

Forum

Thank you in advance. My client, age 70 expects to die of cancer within the year. He wants to purchase...

Read more

Newsroom

America’s IRA Expert Releases New Best-Selling Retirement Planning Book That Includes Secure Act 2.0 Updates; Hosts Live Virtual Book Launch...

Read more

Forum

Can anyone help check the Social Security Administration’s reckoning of a monthly benefit after the addition of “lag year” earnings...

Read more