Forum

If a 401(k) owner names a EDB and NEDB as 50/50 beneficiaries and the 401(k) account isn’t split after death...

Read more

Forum

Hello: I have a client (age 55) who inherited a 401K from her Mother, who died in 2024 her 90s....

Read more

Forum

Client died after RBD, left IRA to son. Son established new Inherited IRA and added beneficiaries on account. Son is...

Read more

Forum

Our client who is 57 inherited her boyfriend, Cletus 401k (Pre-tax and after-tax funds). Cletus was 52 at time of...

Read more

Forum

Several months ago I posted the following question and received the following answer (see original question and original answer below). ...

Read more

Post

Most 401(k) plans (as well as 403(b) and 457(b) plans) offer hardship withdrawals while you are still employed. If the withdrawal comes from a pre-tax account, it will be taxable. And, if you’re under age 59½, it will also be subject to the 10% early distribution penalty – unless one of the exceptions to that penalty applies. For example, hardship withdrawals are allowed for medical expenses.

Read more

Forum

Hello, My client Nancy died in 2017. She was in her 50’s and left her IRA to her spouse....

Read more

Forum

Hello, we are working with a prospect and noticed something they may have done inadvertently and are not 100% if...

Read more

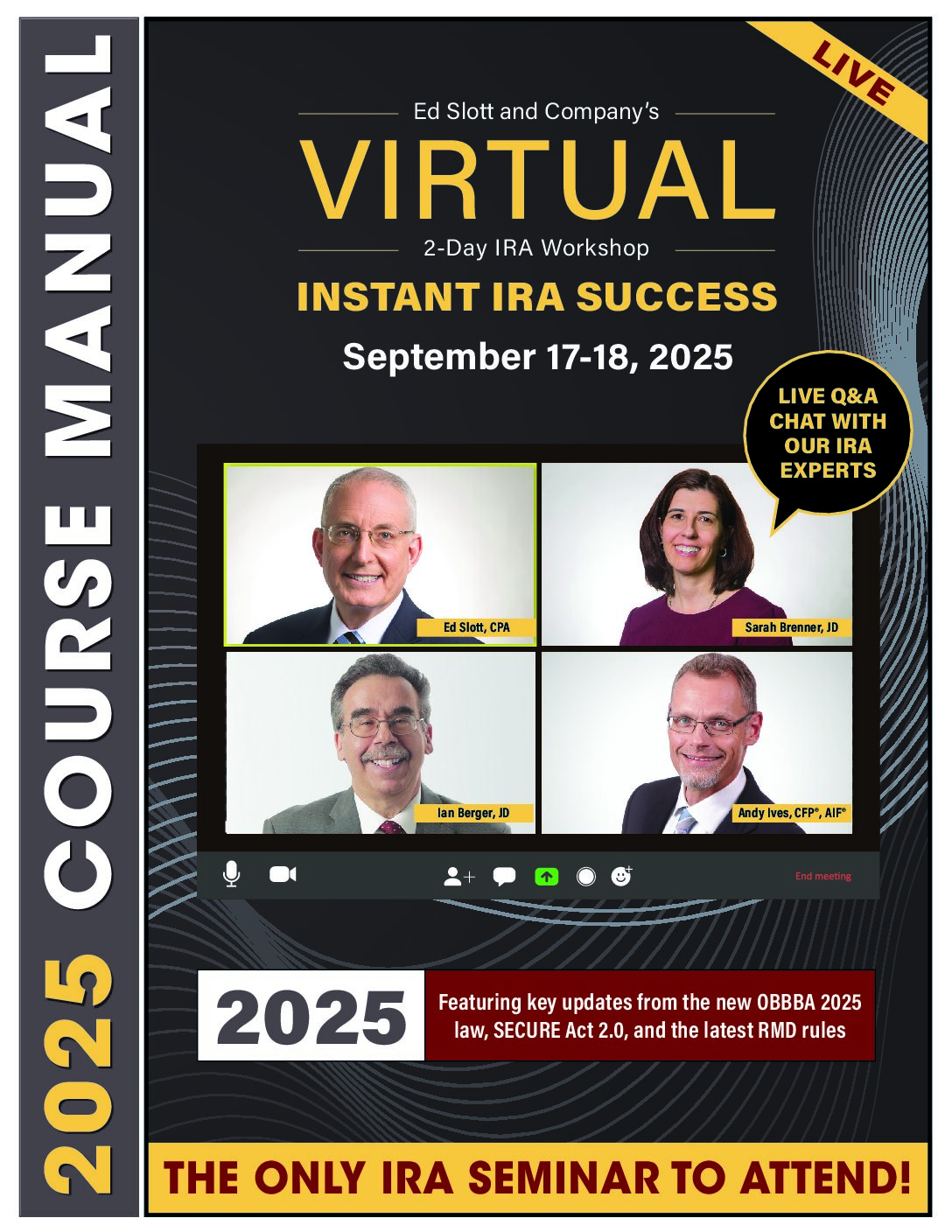

Page

Our 2-Day Instant IRA Success Virtual Workshop will be conducted via Zoom. To join the workshop, simply click this button....

Read more

Forum

Sister owned an IRA. She passed away in 2023 at age 74 (born in 1949). Her sole beneficiary was her...

Read more